Your cart is currently empty!

Get Skylink For A Human Touch to Your Insurance Platforms

Cultivating REAL human connections is much-needed to transform the Insurance Industry

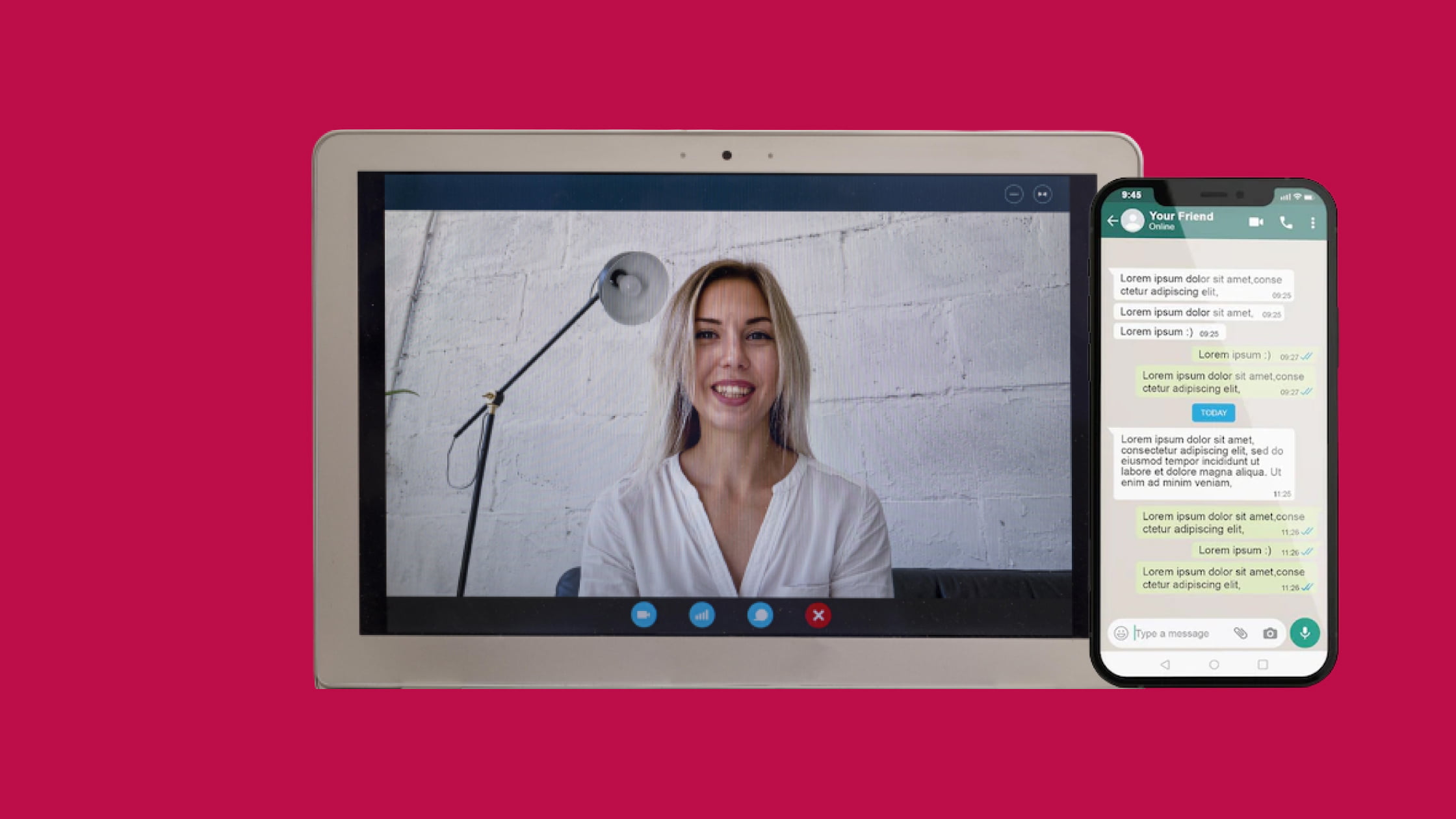

Temasys endeavors to reinvigorate the insurance sector by introducing real human interactions facilitated by Skylink. No-code Skylink Cube and Live Chat Insurance SDK are all set to transform the insurance industry with live one-on-one group collabs, instant messaging, and other modular features.

How can Skylink Cube Modernize the Insurance Sector?

Only 14-percent of Customers are satisfied with current communications with with their insurers

Ernst & Young

Skylink Cube brings virtual group and one-on-one collaborations with rich messaging features to your websites and applications. It’s easy to deploy Skylink Cube as no coding knowledge is necessary. Our Developer-ready Skylink SDKs seamlessly integrate with your portals to offer clients an all-around, humanizing experience.

Signature features of Skylink Cube:

- Bringing the Voice and Video Calling Experience to Service Agents

- Screen Sharing Facility for Added Convenience to Clients

- Immersive Virtual Engagement

- Custom Modular Features

Why only Skylink Cube for the Insurance Industry?

Skylink takes videoconferencing software to the next level. It’s a custom modular solution that is scalable as per your business needs. You can add new features and remove unnecessary ones without rebuilding the entire software ecosystem.

Features that make Skylink an ideal solution for insurance companies seeking to build lasting human connections:

- Adaptive Instant Messaging: Robust group messaging and application-level communication.

- Skylink LiveHD Video: Easy access to webcams and screen sharing with crystal-clear live HD video.

- Skylink LiveHD Audio: High-definition audio for trouble-free, easily comprehensible voice communications.

Use Cases for Skylink Cube in the Insurance Sector

An immersive virtual experience facilitated by Skylink Cube boosts your engagement with potential clients. You can offer virtual awareness sessions, “how-to” tutorials, and more on the go.

Integrated voice chat and video chat, in addition to rich instant messaging features, Skylink makes the integration of real-time communication channels on your digital platforms effortless.

Full Circle Connected Customer Initiatives

For the customer, using real-time communication can have financial rewards. There’s no denying the fact that virtual engagement and always-connected technologies have become an integral part of our everyday lives.

With the ever-advancing technologies in areas such as the Internet of Things (IoT) and wearables, now is the time for insurance companies to innovate and create meaningful connections with their customers by allowing them the flexibility to communicate with them in the ways that they prefer.

This creates an opportunity for insurers to offer smart products that could give customers discounts and incentives for providing extra information about themselves, their vehicles, and their homes.

This design showcases how interactive policies can be a win-win situation for both insurance providers and their users as they interactively share information at all times (in real time).

Connected Customer Perceptions

When customers provide data from their fitness trackers, such as Fitbit, Apple Watches, and others, they can earn discounts for achieving health and fitness goals such as average steps taken per day.

Installing a dashcam can also reduce your car insurance premiums and can lead to better outcomes for safety and injury prevention. Having video footage from accidents makes claims quicker and easier to resolve and can also eliminate fraud, which costs insurance companies millions of dollars per year.

Sharing video data from your car dashcam or sharing GPS data leads to safer driving, too. In a recent study of in-vehicle telematics, it was demonstrated that using such data leads to safer driving.

Creating smart houses that are network connected through IoT devices, gives insurance companies more opportunities to give discounts and drive new business. According to a recent study from McKinsey, insurance companies are examining how smart houses improve the living conditions for persons living in assisted living spaces. Ultimately, a better monitored, more connected home can cut costs for insurers and customers.

Want to Start Using Skylink for Insurance Services?

Make your business human-to-human interaction-ready with “Skylink Cube Essentials” as a free-of-cost subscription plan. You can switch to our affordable fixed-cost plans for extra, much-needed features like uninterrupted HD voice and video calls, message persistence, etc., for as low as $1 a day. Our growth depends on your success!

About the Author:

We’d love to hear your ideas and talk about how we might work together.

Our latest posts