How Live Chat Can Answer Queries Better in the Insurance Space?

Looking for a better way to answer customer queries in the insurance industry? Insurance claims chatbots can help with insurance questions and answers.

Introduction

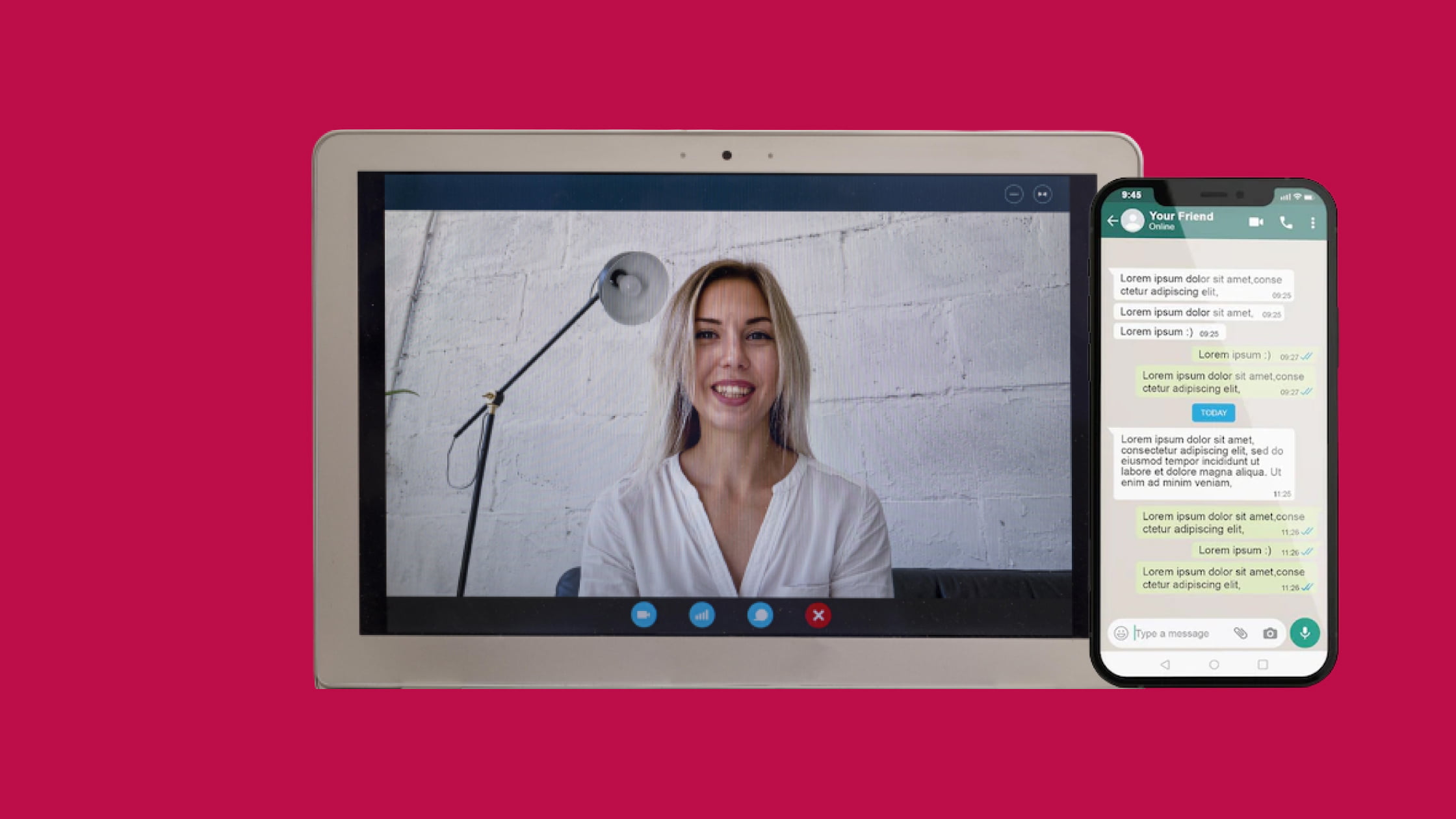

Live chat software is the ideal solution for improving your insurance company’s customer service. You can provide quick quotes about insurance policies and guide website visitors through the buying process step-by-step using live chat functionality on your insurance website. Insurance questions and answers can be resolved for the leads instantly.

However, by integrating insurance bots and live chat integrations, insurance service providers can truly offer a two-way interaction that surpasses traditional transactions and bridges consumer expectations.

In this article, we will discuss how live chat can better answer queries in the insurance sector.

Ways How Live Chat Can Answer Queries Better in the Insurance Space

With live chats and insurance chatbots, your sales department can equip itself with relevant and valuable insights about your customers while serving as its insurance manager through a virtual assistant. Listed below are some of the ways how live chats can answer queries better in the insurance space:

- Education and Awareness of Customers

With the use of live chats and chatbots in insurance, customers are able to gain an understanding of what the insurance process consists of, as well as compare and suggest the most appropriate policy from several carriers based on the customer’s profile and input. Aside from that, it can be used to interact and engage with every visitor, regardless of whether they are on your website or other channels, thereby increasing your conversion rate.

- Profiling and Converting Leads

The bots and live chat can segment different groups of users and provide them with relevant quotes and information based on their inputs and queries. When a sales team has access to this data, they are in a better position to help potential customers with similar needs as they know what they are looking for and can proceed accordingly.

According to recent research, if you do not respond to a client’s query within 6 minutes of when they contact you, your chances of converting them into a warm lead decrease by over 400% for that customer. An insurance chatbot and live chat support is a great asset in these scenarios because it increases the probability of converting a lead and provides instant feedback to the user.

- Assistance With Claims and Payments

Using claims chatbot and live chats, your customers’ insurance claims can be handled efficiently, as well as follow up on the existing claims that have already been made by your company. Additionally, a customer can be prompted for upcoming payments as well as payment process can be simplified across the channel of choice of the customer.

- Sales & Pre-sales:

Some consumers would be more likely to make a purchase if they were able to contact the business directly. Live chats and chatbots can build relationships between potential customers and your brand and differentiate customers based on their purchase intent. Sales representatives can use initial conversations to assign higher intent scores to leads further down the funnel so that they can qualify as inbound leads.

- Reviews & Feedback from Customers

There is research that indicates that 72% of customers prefer live chat over e-mail as a method of contacting the company, and 55.9% of consumers prefer contacting the organization through chats rather than phone calls. It is because people tend to view websites as a static medium, so any kind of interaction occurring on the medium makes for a very good customer experience since they are used to seeing them that way. The company is also able to encourage clients to leave positive comments and collect feedback from them, in addition to that.

- Rich Database

The insurance industry is no exception to this rule as it aims to expand its e-mail connection list as much as possible, and all businesses want to grow their e-mail list. When users interact with a live chat or a chatbot, their contact information is collected by the chatbot or live chat service. The connection details of the users can be inserted into the customer database so that they can receive future updates on social media, newsletters, and e-mails.

Conclusion

So now you might have understood how live chats play a very important role in the insurance sector. We also discussed how live chat could answer customer queries better in the insurance space, increasing customer satisfaction and thus increasing the conversion rate for insurance businesses. If you’re interested in gaining all the benefits that live chat can bring to your insurance business, then get in touch with Temasys as soon as possible.

Temasys’ Skylink Cube live chat support systems are designed primarily to increase revenue and retain customers by providing great service. Deploying Skylink Cube by Temasys to get live chat support for your business can boost your conversion rate. Whether you need to convert a cold lead to a warm lead or a warm lead to a hot one, our live agent can make it possible.